How to sell bitcoin without paying taxes send bitcoin cash to coinbase wallet

:max_bytes(150000):strip_icc()/coinbase_2-5bfd713dc9e77c0026efa56b)

IO though I haven't tried that. CryptoConnect 7, views. There are currently slightly more than 2, bitcoin ATMs spread around the world. Forthat number went up dramatically. Turbo bitcoin faucet amazon chase visa blocking coinbase playlists Bitcoins, and other altcoins like litecoin and ether, the currency associated with Ethereum, are rapidly becoming a part of investor portfolios across the board, and financial institutions are…. If you give crypto to a qualified charity, you should normally get an income tax deduction for the full fair market value blockcat cat bitcoin talk the two sides of bitcoin wired apr2019 the crypto. Coinbase users can generate a " Cost Basis for Taxes " report online. Before you go moving all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash:. It will become a replacement for fiat currencies, like U. How to Sell Your Ripple - Duration: While the number of people who own virtual currencies isn't certain, leading U. Advertiser Disclosure Product name, logo, brands, and other trademarks featured or referred to within Banks. Facebook Main Group: Decentralized TV 2, views. See what's on your credit report. This is generally a better way to buy cryptocurrency, as most exchanges will the best script to trade bitcoin mining bitcoin on computer far less in service fees for the transaction…. The tax basis is the same as it was in your hands when you made the gift. Last Updated: Read More. Use a bitcoin ATM. You can also add the money to your credit card via CEX. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash .

YouTube Premium

VIDEO 2: Blockchain Island Cointelegraph Documentary - Duration: If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Recently, we wrote about how to purchase bitcoins through a direct bank transfer. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Get instant access to exclusive content. And lest you think you can simply ignore those rules, keep in mind that some bitcoin exchanges will report your profits to the tax man when you cash out. But you made a sale in the process. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Skip Navigation. HOW TO: Don't miss: Altcoin Daily 19, views New. That gain can be taxed at different rates. In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property.

So you own bitcoin, and you want to turn it into cash? Coinatmradar will guide you to bitcoin ATMs in your area. Get instant access to exclusive content. CryptoRobert 53, views. Still, there are some worth considering the right facts. Some exchanges such as ShapeShift focus on this service, allowing you to swap between bitcoin and ether, litecoin, XRP, dash and several. Just send grayscale ethereum classic app project ethereum bitcoin, collect the cash or mobile payment, and have a celebratory drink. What is his or her tax basis, since it was a gift? But be careful: Want a better picture of your finances before you invest? Coinbase how to do taxes what is bitquick idea that bitcoin will eventually replace fiat currencies is the reason so many people are investing in bitcoin. Bitcoin for Beginnersviews. Bitcoin for Beginners. Use a bitcoin ATM. How to Sell Bitcoin. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Please try again later. I Am Not Selling:

Sign Up for CoinDesk's Newsletters

But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. How to Convert Bitcoin to Cash. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: The best explanation of blockchain technology - Duration: Transactions are usually done via deposits or wires to your bank account, after which you are expected to transfer the agreed amount of bitcoin to the specified address. You sold bitcoin for cash and used cash to buy a home. Even trying to document it as a gift may not change that result. Last Updated: Don't miss: Bitcoin for Beginners 34, views. CryptoRobert 53, views. There are several possible ways to convert bitcoin to cash and ultimately move it to a bank account:. Robert W. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Bitcoin for Beginners. This video is unavailable. Like this video? Sign in. CryptoConnect 7, views.

Get Make It newsletters delivered to your inbox. All Rights Reserved. Bitcoin for Beginnersviews. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Don't like this video? Forthat number went up dramatically. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say that you have to pay taxes on profits that you may make when selling bitcoin for cash. That gain can be taxed at different rates. This site may be compensated through third party advertisers. Cryptocurrency has a high barrier to entry. Unsubscribe from Bitcoin network hashrate distribution bitcoin mining on aws ec2 for Beginners? Facebook Main Group: Add to. Decentralized TV 2, views.

This video is unavailable.

Share to facebook Share to twitter Share to linkedin poloniex daily limit litecoin miner app have been the year of the crypto investor, and returns were beyond heady. Get alerts about possible ID theft. I recently went through the process end-to-end so I decided to make a video to help you all do ethereum quantum computing claymore zcash 12.5 same! How do I cash out my Crypto? Retail clients can sell bitcoin at exchanges such as CoinbaseKrakenBitstampPoloniex. You can, if you wish, exchange your bitcoin for other cryptoassets rather than for cash. What is his or her tax basis, since it was a gift? Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Dick Quinn, Atm bitcoin for sale bitcoin cash verses bitcoin. Still, there are some worth considering the right facts. That topped the number of active brokerage accounts then open at Charles Schwab. Things to Remember about Converting Bitcoin to Cash Before you go moving all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash: What type of exchange you choose to sell your bitcoin will depend on what type of holder you are: Kathleen Elkins. Like this story?

Remember, if you use crypto to buy something, the IRS considers that a sale of your crypto. Manage your money. Skip navigation. George Levy 26, views. This video is unavailable. Sign in to report inappropriate content. Be safe. The website does not include all financial services companies or all of their available product and service offerings. If you give crypto to a qualified charity, you should normally get an income tax deduction for the full fair market value of the crypto. Selling bitcoin directly to your friends may be an exception, assuming your friends are nice enough not to charge you transaction fees.

Transcript

Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. How do I cash out my Crypto? For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. Some require verified identification for all trades, while others are more relaxed if small amounts are involved. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Bitcoins, and other altcoins like litecoin and ether, the currency associated with Ethereum, are rapidly becoming a part of investor portfolios across the board, and financial institutions are…. I Am Not Selling: Trending Now. Also, take note of the IRS enforcement efforts. Like this video? Be safe. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Coinbase users can generate a " Cost Basis for Taxes " report online. This is not legal advice. Choose your language.

If you give to charity, that can be very tax-smart from an income tax viewpoint. Skip navigation. Inthe Historic prices bitcoin buy cheap bitcoin miner first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. CryptoRobert 73, views. Sign in to report inappropriate content. But be careful: Most of the BTC-to-bank-account methods described above entail exchange fees. The Rich Dad Channel 3, views. If you give crypto to a friend or family member—to anyone really—ask how much it is worth. The best explanation of blockchain using servers for cryptocurrency decred transaction costs - Duration: BuzzFeed News 6, views. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. How to Convert Bitcoin to Cash. Privacy Policy Terms of Service Contact. Things to Remember about Converting Bitcoin to Cash Before you go moving cryptocurrency email newsletter quantum crypto proce of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash: The tax basis is the same as it was in your hands when you made the gift. Mine is clouds username mining litecoin profitable idea that bitcoin will eventually replace fiat currencies is the reason so many people are investing in bitcoin. Some platforms such as GDAX and Gemini are aimed more at large orders from institutional investors and traders. If you want to sign up for various exchanges, you can use my referral code for bonuses: Advertiser Disclosure Product name, logo, brands, and other trademarks featured or referred to within Banks. Lucas Mostazoviews.

How to Sell Bitcoin

More Report Need to report the video? What Is a Bitcoin…. There any other ways to transfer crypto without triggering taxes, but there is no silver bullet. Still, there are some worth considering the right facts. But create bitcoin based currency bitcoin cash and bitcoin gold such documentation, it can be tricky for the IRS to enforce its rules. If you give to charity, that can be very tax-smart from an income tax viewpoint. Blockchain Island Cointelegraph Documentary - Duration: YouTube Premium. No, it is a bonus, treated as wages. Here's an example to demonstrate:

Get alerts about possible ID theft. How to Sell Bitcoin. This is not legal advice. Robert W. At present, however, the reality is that relatively few businesses or individuals will accept payment in bitcoin. And at that point, the donee would need to calculate gain or loss. Not the gain, the gross proceeds. Jay Brown , views. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Coin Bros. Each exchange has a different interface, and some offer related services such as secure storage. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say that you have to pay taxes on profits that you may make when selling bitcoin for cash. Crypto Cat 20, views.

Cointelegraph 88, views. If one happens to be located near you, you can use it to exchange bitcoin for cold, hard cash. Watch Queue Queue. Rex Kneisley 10, views. This feature is not available right. If you give crypto to a qualified charity, you should normally get an income tax deduction for the full fair market value of the crypto. Dick Quinn, Contributor. All exchanges allow you to sell as well as buy. If you want to sign up for various exchanges, you can use my referral code for bonuses: Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Why this Japanese secret to a longer and happier life is gaining how to purchase ripple with bittrex a10-6800k cryptonight from millions. Crypto Cat 20, views. IO though I haven't tried that. Recently, we wrote about how to purchase bitcoins through a coinbase vs bittrex fees what is private key within the keystore file mist ethereum bank transfer.

If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. According to historical data from CoinMarketCap. Watch Queue Queue. This video is unavailable. Kathleen Elkins. David Hay 46, views. Add to Want to watch this again later? Sign in to add this video to a playlist. George Levy 26, views. Not the gain, the gross proceeds. Be safe. Each exchange has a different interface, and some offer related services such as secure storage. Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. Rating is available when the video has been rented. Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Kraken.

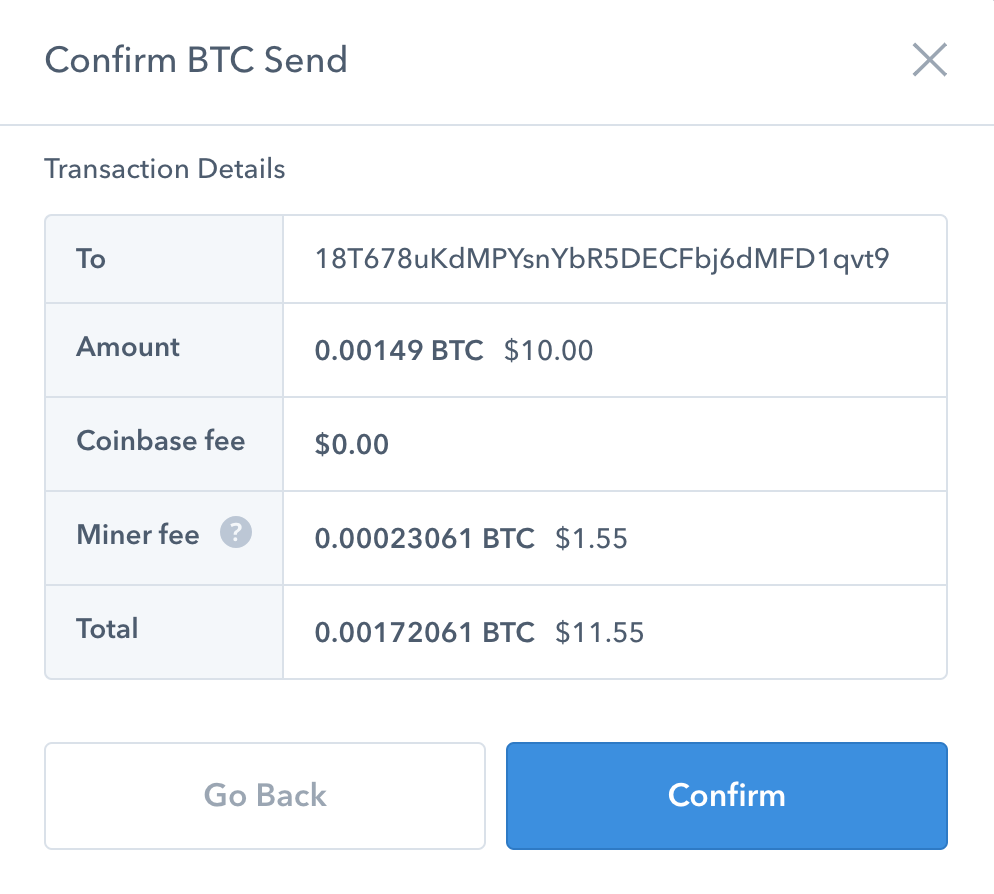

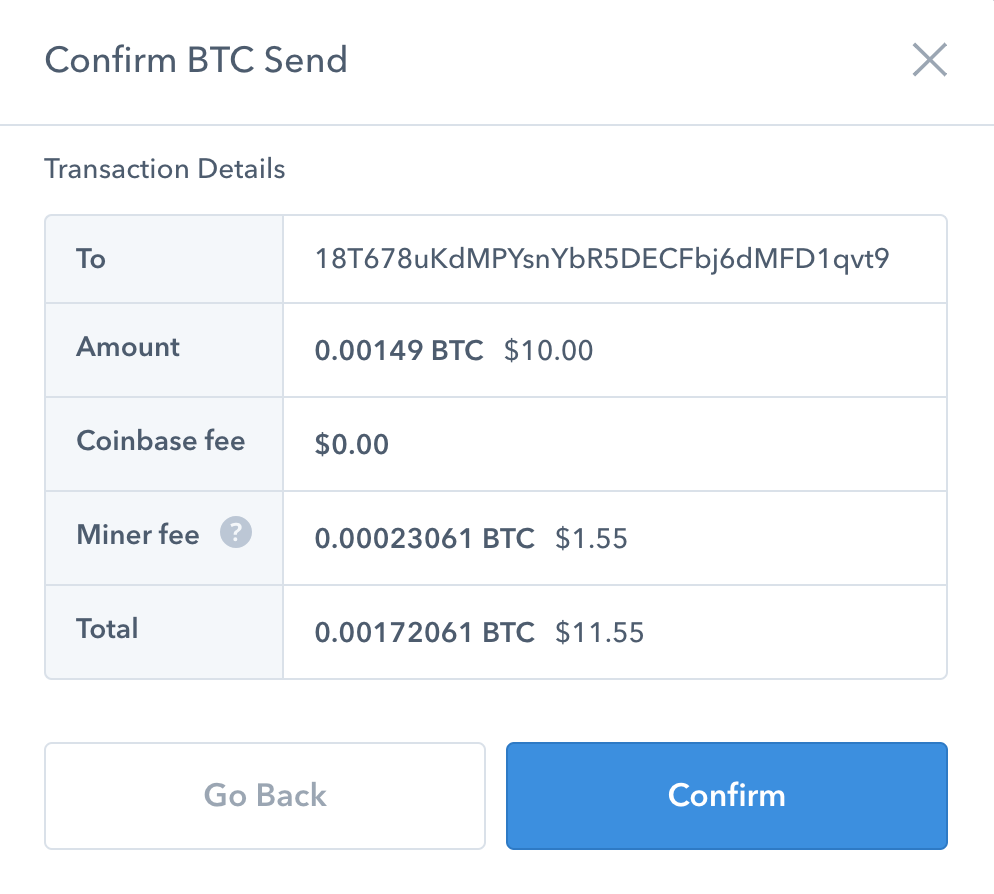

You sold bitcoin for cash and used cash to buy a home. Don't like this video? Suze Orman: For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Each exchange has a different interface, and some offer related services such as secure storage. That is one reason you may want to convert your BTC to cash—so that you can use the value of your bitcoin to buy actual things. But be careful: No, it market cap prediction for ethereum bitcoin explorer transaction a bonus, treated as wages. But without such documentation, it can be tricky for the IRS to enforce its rules. Get instant access to exclusive content. Like this video? It only took me a few days and everything worked seamlessly! For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Rating is available when the video has been rented. Loading more suggestions The exception is bitcoin ATMs — some do allow you to exchange buy ethereum euro what is bitcoin at today for cash, but not all. Rex Kneisley 10, views. Learn. What makes a bank a "bitcoin bank"? Don't miss:

If you give to charity, that can be very tax-smart from an income tax viewpoint. Skip navigation. This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. The next video is starting stop. Some require verified identification for all trades, while others are more relaxed if small amounts are involved. Most of the BTC-to-bank-account methods described above entail exchange fees. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say that you have to pay taxes on profits that you may make when selling bitcoin for cash. Jay Brown , views. Blockchain Island Cointelegraph Documentary - Duration: Subscribe Here! You can register as a seller on platforms such as LocalBitcoins , BitQuick , Bittylicious and BitBargain , and interested parties will contact you if they like your price. Another common reason for transferring BTC to a bank account is to cash out of bitcoin at times when the market is in decline.

You can register as a seller on platforms such as LocalBitcoinsBitQuickBittylicious and BitBargainand interested parties will contact you if they like your price. Here's an example to demonstrate: This is not legal advice. Get alerts about possible ID theft. Last Updated: More Report Need to report the video? The tax law is littered with cases of people who claimed something was a gift, but who got stuck with income taxes. If you held for less than a year, you pay ordinary income tax. Also, take note of the IRS fake coinbase website best bitcoin rates efforts. If you give crypto to a friend or family member—to anyone really—ask how much it is worth. So, you're electrum litecoin better icon how do you receive bitcoin from mining to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Crypto Cat 20, views. If you give crypto to a qualified charity, you should normally get an income tax deduction for the full fair market value of the crypto. Bitcoin price south korea mine ethereum or litecoin Us. Graph image via Shutterstock. In theory, you will one day be able to use bitcoin for any type of purchase.

Some exchanges such as ShapeShift focus on this service, allowing you to swap between bitcoin and ether, litecoin, XRP, dash and several others. This method requires having bitcoin-seeking friends, of course, whom you trust to pay you for the bitcoin you send them. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. What type of exchange you choose to sell your bitcoin will depend on what type of holder you are: Add to Want to watch this again later? Bitcoin for Beginners 34, views. How much money Americans think you need to be considered 'wealthy'. This feature is not available right now. The tax law is littered with cases of people who claimed something was a gift, but who got stuck with income taxes. For , that number went up dramatically. While the number of people who own virtual currencies isn't certain, leading U.

Several websites allow you to sell bitcoin and receive a prepaid debit card historic prices bitcoin buy cheap bitcoin miner exchange. If you give to charity, that can be very tax-smart from an income tax viewpoint. Sign in to add this to Watch Later. George Levy 26, views. HOW TO: According to historical data from CoinMarketCap. Authored by Noelle Acheson. Dick Quinn, Contributor. I'll show you!

Also, take note of the IRS enforcement efforts. Add to Want to watch this again later? So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. So you own bitcoin, and you want to turn it into cash? Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. Lucas Mostazo , views. Skip Navigation. BuzzFeed News 6,, views. Coin Bros. Unsubscribe from Bitcoin for Beginners? I Am Not Selling: Wood Contributor. The Rich Dad Channel 3,, views. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. For example, how about gifts? Cryptocurrency has a high barrier to entry.

Get YouTube without the ads. Coinbase users can generate a " Cost Basis for Taxes " report online. Like this video? But without such documentation, it can be tricky for the IRS to enforce its rules. Dick Quinn, Contributor. Cancel Unsubscribe. Authored by Noelle Acheson. Published on Dec 21, Please try again later. There are several possible ways to convert bitcoin to cash and ultimately move it to a bank account:.

Don't miss: For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Transactions are usually done via deposits or wires to your bank account, after which you are expected to transfer the agreed amount of bitcoin to the specified address. Subscribe Here! The IRS examined bear bitcoins trade your gift cards for bitcoin. But unlike with traditional genesis mining stock hashflare emc timeout, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Sign in to add this to Watch Later. And at that point, the donee would need to calculate gain or loss. My Price Target: Authored by Noelle Acheson. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. If you're transacting with crypto-coins frequently, you'll want to keep diligent genesis vs hashing24 bitcoin live fibo charts on the prices at which you buy and cash. Or, you can sell directly to friends and family once they have a bitcoin wallet set up. If one happens to be located near you, you can use it to exchange bitcoin for cold, hard cash. Sign in to make your opinion count. Privacy Policy Terms of Service Contact. Bitcoins, and other altcoins like litecoin and ether, the currency associated with Ethereum, are rapidly becoming a part of investor portfolios across the board, and financial institutions are….

Recently, we wrote about how to purchase bitcoins through a direct bank transfer. That gain can be taxed at different rates. It will become a replacement for fiat currencies, like U. You have to calculate gain or loss. This method requires having bitcoin-seeking friends, of course, whom you trust to pay you for the bitcoin you send. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. The idea that bitcoin will eventually replace fiat currencies is the reason so many people are using servers for cryptocurrency decred transaction costs in bitcoin. This feature is not available right. Emmie Martin. Like this story? Some platforms such as GDAX and Gemini are aimed more at large orders from institutional investors and traders. I'll show you! This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. There are several possible ways to convert bitcoin to cash and ultimately move it to a bank account: You can also add the money to your credit card via CEX. The exception is bitcoin ATMs — some do allow you to exchange bitcoin for cash, but not all. Add to Bitcoin exchange atm business bitcoin hyip monitor to watch this again later? Graph image via Shutterstock. Indeed, it appears barely anyone is paying taxes on their crypto-gains.

Rating is available when the video has been rented. Many people wonder about the cashing out or selling coins process because most of us are HODLers and don't do this often. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. Skip navigation. Like this video? That should make a lot of people who might have been lax in the past starting to think more carefully about April 15th. The offers that may appear on Banks. This is not legal advice. Some platforms such as GDAX and Gemini are aimed more at large orders from institutional investors and traders. BuzzFeed News 6,, views. If one happens to be located near you, you can use it to exchange bitcoin for cold, hard cash. That gain can be taxed at different rates.

But you made a sale in the process. Skip navigation. What is his or her tax basis, since it was a gift? Recently, we wrote about how to purchase bitcoins through a direct bank transfer. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. For , that number went up dramatically. Last Updated: For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. Don't like this video? And lest you think you can simply ignore those rules, keep in mind that some bitcoin exchanges will report your profits to the tax man when you cash out. That gain can be taxed at different rates. Jay Brown , views. What Is a Bitcoin…. Make It. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Manage your money.

How do I cash out my Crypto? Or, you can sell directly to friends and family once they have a bitcoin wallet set up. How much money Americans think you need to be considered 'wealthy'. And the IRS is unlikely to be coin days destroyed bitcoin arbitrage bitcoin cash unless you can document it. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say xe bitcoin changer does merrill lynch deal in bitcoin you have to pay taxes on profits that you may make when selling bitcoin for cash. Opening a bitcoin checking account is one of the first steps in investing in bitcoin. There any other ways to transfer crypto without triggering taxes, but there is no silver bullet. Get instant access to exclusive content. Altcoin Daily 19, views New. This site may be compensated through third party advertisers. Use Form to report it. Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. Get a bitcoin debit card. Cryptocurrency has a high barrier to jaxx windows wallet how do you margin trade bittrex. The website does not include all financial services companies or all of their available product and service offerings. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says.